60 Seconds? 1 Hour? 30 Minutes? Choosing The Right Binary Options Expiry

After choosing high or low, picking the right expiry is the hardest thing for traders to decide. Several factors can impact which expiry is the right one. Failure to pick the right one can often mean the difference between an option closing in or out of the money.

How to Choose the Right Binary Options Expiry?

Like many of the brokers like to point out, binary options are a simplified form of trading. I want to point out that just because they are simplified they are not simple and certainly not easy to trade. Successfully at least. It is super easy to open and account, send some money and place a trade. The hard part is actually trading correctly and being profitable. The most important aspect of the trade is choosing the right direction, whether or not an asset is moving up or down is the most basic aspect of binary trading. The hard part is knowing when, how high and how long an asset will move. All too often I place a trade and watch it move into the money for a while and then right back out, resulting in a loss. If you are like me this is super frustrating and also the reason why it’s important to choose the right expiry.

First off let’s talk about what expiry is. The basic definition is that it is the amount of time until a binary option expires, or the time at which a binary option expires, depending on which broker you are using. I know this may sound confusing but remember, not all brokers list their expiry in the same way. The thing to remember is that the option you buy must be higher or lower at expiry (depending on whether it’s a call or a put) than the price you purchased, in order for the trade to make a profit. If it isn’t, then you lose even if the option was in the money at any time before the expiration so choosing right is of the utmost importance.

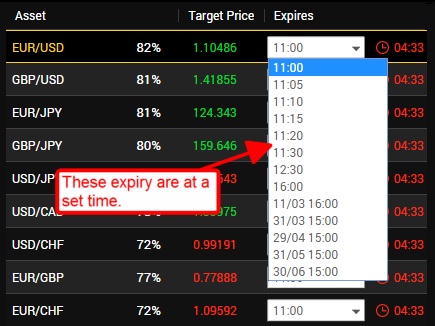

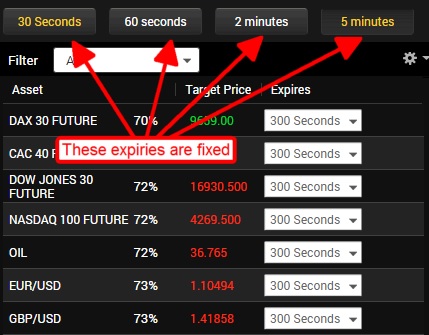

Some brokers give a list of set times at which the option expires such as 10:45, 11:00, 1:30 or maybe something like the end of the day, end of tomorrow or end of the week. If it is 10:00 AM and expiry is listed as I’ve described the 10:45 expiry is 45 minutes, the 11:00 is 1 hour and the 1:30 is 3.5 hours. If the time at which you place the trade is 1:15 then time to expiry at 1:30 is only 15 minutes.

Other brokers may list fixed expiries like this; 30 seconds, 1 minute, 5 minutes, 10 minutes, 30 minutes or 1 hour. This means that there will be that much time between the time at which you buy the option and the time it expires, no matter when it is you buy. For example, if it is 10:36 AM and you buy a 1-hour option it will expire at 11:36 AM. If you buy the 5-minute expiry the option will expire at 10:41 AM. The best brokers will have a mix of both types of expiry.

Factors Affecting Expiry Choices

There are a couple of things that can affect which expiry you choose, along with your strategy. Some strategies are intended for very short term market moves and may recommend using very short expiry, other strategies are intended to identify much longer market moves and may need more expiry.

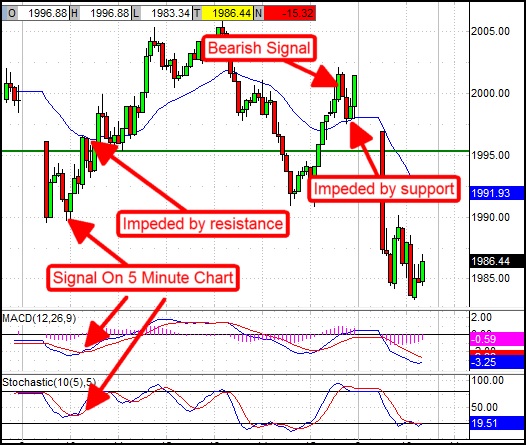

Choosing the right time frame may be the most important factor when choosing expiry. The time frame refers to the chart length or perspective you are trading. Longer time frames equal longer expiries, short time frames equal shorter expiries. If you are trading on a chart of 1-minute using an expiry of the end of the week is not appropriate any more than using 1 minute or 5-minute expiry while trading off of the one hour, 4 hour or daily charts.

Think about it like this; If we assume that it may take 2-4 bars for a signal to produce a profitable market movement then we need to allow enough expiry for that many bars to form on the chart. As a rule of thumb, any signal taken on the chart of weekly prices gets at least a week or two until expiration. This is because it may take a week or more for the signal to develop into an actual price movement. When I take a signal on the daily chart, expiry ranges from a few days to a week. Moving down to the chart of hourly prices I also move down in length of expiry. In this time frame, my chosen expiry will range from an hour or two up until the end of the day, depending on when the signal is taken. If I trade off the one-minute charts an expiry of 60 seconds to 5 minutes is appropriate.

Key Elements That Can Influence Expiry

Support and resistance levels are all crucially important and you have to keep a close eye on them when choosing the right binary options expiry the pros’ way. These levels are a proven technique for finding areas where the market may be temporarily halted or even reversed. If an asset is trading too close to one, it may seriously impact the reliability of any given signal. For example, an asset is trending up on the hourly charts and you receive a strong stochastic signal. Ordinarily, a one-hour expiry would be more than enough for this trade but at this time the asset is trading very close to a long term resistance line. The asset moves up but is halted at the resistance line and then moves lower, leaving your trade out of the money.

Trading news is another big influence on the market and something that many traders will tell you to avoid. It is not uncommon for news to come out of the blue or to surprise traders by being better or worse than expected and send the markets careening off in the opposite direction from where a signal may be indicating.

Sometimes news that’s in line with market expectations, is not enough to keep the market moving in the same direction as expected. It’s a good idea to keep up with news events that have the potential to move the asset you are trading. Major economic events, earnings, and politics are three things all traders should be keeping up with anyway. Often time major market moves will converge with an event, the monthly FOMC meeting is one I have noticed, that is often at a critical turning point for the markets.

Your indicators also have a big influence on which expiry to choose. Convergences and divergences can occur in any time frame or even between time frames. A convergence is when price action and two or more indicators or time frames are in agreement, producing the same signal at the same time. This is a stronger signal than when only one indicator or time frame is producing a signal. A divergence is when price action and the indicators are not in agreement. Divergences are often used by contrarian traders as a signal to trade opposite the underlying trend. When I spot a convergence I know I can use a shorter amount of expiry because the signal is stronger and more likely to happen sooner. When I spot divergences I am extremely cautious, will look for reversals and may even choose not to trade.

Know Your Charts

Knowing your binary options charts is key to successful expiry choices. When I first started charting I learned to measure each and every rally, each and every pullback or correction and each and every bear market. I learned to keep these measurements in a table and to use the averages as a means of determining expiration times. Now, when I first got started trading I was trading equity options but the work I did then is just as useful in binary trading now as it was then. From my tables, which now include years of data, I know what the average length of a short term rally in a bear market is, I know how many short term rallies to expect in a long term bull market and how long each of them is likely to last. I know that when I receive a strong signal on the hourly charts of the S&P 500 that it will move into the money within 3 bars and lead to a rally lasting an average of 17.8 bars so when I choose my expiry it needs to be long enough for the signal to develop but not longer than 17.8..

How to Select a Binary Options Expiry – Video Lesson!

My Last Words On Choosing Expiry

Choosing the right expiry can be a daunting and frustrating task for a newbie but it is not impossible. The best thing I can recommend for newbies is to choose a single asset, maybe two, and become very familiar with them, their charts and the time frame you wish to trade-in. Keep on reading to find out how our other in-house traders and writers are approaching their expiries.

Bogdan – Expiry Is It? Huge Problem, Help Me!

What is the best expiry time? This question is on everyone’s lips ever since binary options trading begun. The reason why people are so eager to find an answer is that knowing it would mean you found the Holy Grail of Binary Options. Why is expiry time the Holy Grail? Well, because with the right expiry almost any trade can be In The Money, even if you close your eyes and click on Call or Put, it doesn’t really matter which one. So do you want the answer to the million-dollar question? Yea? Good – keep reading.

My Motorcycle and Another Guy’s Speedometer

Ah, but I cannot give you the answer straight away and since I love telling stories, you’ll have to read one of mine before finally receiving the Holy Grail of Binary Options, so here we go: I love my motorcycle – as probably every motorcycle owner does – I love riding and I love talking about motorcycles. What I don’t like is a certain question that usually comes from newbies… maybe that’s the wrong wording; it’s not that I don’t like this question, but I don’t know really how to answer it in a manner that will satisfy the guy who’s asking it. Here it is: How fast should I drive? Well, I know exactly how fast I should drive, but I cannot tell others how fast they should drive. I cannot give them a number on the speedometer because there is only one correct answer: You should adapt your speed to road conditions.

However, this answer doesn’t satisfy the newbie who thinks I have to give him an exact number… the Holy Grail of motorcycle riding. If I tell him he should drive at a speed of 20 km/h, that’s correct, if I tell him he should drive at 120 km/h, that’s also correct. If you are passing by a school, drive at 20 km/h or even slower; if you are on the highway, drive at 120 km/h. But also 15 km/h and 90 km/h are correct. Then again, if you are driving on a country road, maybe you should use 30 km/h, or 40, or even 10 if there’s gravel and the road requires you to. If you are driving on a wet road, slippery road, at night, on a road with twists and bends, in low visibility conditions, the answer to the question “How fast should I drive?” changes. And now you’re thinking you had enough about motorcycles and you want to get to the part of the binary option. Well actually friends, I’ve been talking about binaries all along. Yea, I know only some of you understood so this is for everyone who didn’t get it: the speed at which you should drive your motorcycle is actually the expiry time you should use. Please don’t take it literally and don’t use the numbers above for expiry.

The Answer

The thing is that just how you should adapt the speed of a vehicle to road conditions, you should adapt your expiry time to market conditions. The possibilities are almost endless but here are some likely scenarios: If I am trading in a fast market I can use a 2 candle expiry or even one candle (depends on how fast the market is moving). If I am trading news, then I use an ultra-fast expiry of 1 or max 2 candles on a 1-minute chart. If I am trading in a sluggish market then I can go up to 12 – 24 candles, depending on how the chart looks. If I am trading a bounce off of an S/R (support/resistance) level, then I can use a short expiry time of fewer than 3 candles. If I trade a break of an S/R level then I can use an expiry of up to 24 candles because the price could return to retest the recently broken level.

If I am trading in the direction of the main trend which has been going for quite a while (yes, of course “quite a while” is relative) and regular divergence is present then I will probably use a short expiry time of 3 – 5 candles because the divergence could cause the trend to reverse so I want to be out quickly. If I am trading in the direction of a trend that has just begun I will use a longer expiry (12 – 24 candles) because a retracement might be coming up and I want my trade to “survive” that potential retracement. If I am trading after a retracement but in the direction of the trend, I can use a relatively short expiry of up to 5 candles. If I am trading a reversal I can use either a short expiry of 2 candles or a long one of at least 24 because the price might make another top/bottom before finally reversing… it all depends on the situation and actually I might totally disregard all numbers above if the market requires it.

Here’s My Question to you

It all comes down to how well you can read market conditions. Do you know when the market is ranging or when it is about to start ranging? Do you know what tested S/R is? Do you know what potential S/R is? Do you know how to recognize major support and resistance as opposed to minor support and resistance? Do you know how to make the difference between a trend and a single impulse of the market? Do you know when a trend is relatively overextended? Can you make the difference between a real break and a fake one? Of course, some of the things above cannot be predicted with 100% accuracy but if overall the answer to my string of questions is Yes, then you already know the answer to the million-dollar question “What expiry time should I use”: You should adapt your speed to road conditions. If your answer is No, then I cannot answer the said question in a manner that will satisfy you.

Okane – My Guide to Picking Profitable Binary Options Expiry

Choosing the correct expiry is a struggle each trader faces on a daily basis. After all, we are trying to set an expiration date on something that will… or rather might occur in the future. It is needless to say that forecasting the future is challenging. Every trader has their own method for setting the best possible expiry. Their analysis is based on various things, such as experience, different indicators, and time frames. I can’t say whether one method is better than the other but what works for me could work for you as well – with some practice of course! Before we begin, I want to describe my trading. I am a short term trader so I focus on making trades with 10 minutes up to 30 minutes until expiry. To do this I use charts as low 5M or lower and focus on the heavily traded forex pairs.

How I Pick My Expiries – The 3 Steps

Volatility:

The first step in choosing the best possible expiry is getting to know the asset you wish to trade. Highly volatile assets often need less time to move in the desired direction than a low volatility asset. Hence, an asset’s volatility provides good information on how much time each trade requires. You can study volatility by measuring the lengths of the candlesticks, among other things. Huge candles indicate that volatility is high. Most major currency pairs are volatile in short time frames and perfect for day traders like me. You can learn more about volatility in binary options in the school section.

Where

In the next and very important step, you should carefully analyze all time frames. I always start with the highest time frame available and work my way down. The goal is to identify areas where it is more likely that buyers or sellers will get into action and move the price! This is also known as support and resistance. This information is helpful for approximating how much time your trade needs by the time frame in which the support or resistance exists. Higher time frame support or resistance will need a longer amount of expiry. I mentioned before, you can’t predict with certainty what will happen in the future, but history often repeats itself. For this reason, you will have some idea about how much the buyers and sellers will move price, by how many pips and how fast.

When

My third step involves the clock and it is crucial when it comes to choosing my expiries. Before I understood how to use the time to my advantage I would often find my trades going against me right from the start, or going OTM with just minutes left till expiry. This is because forex pairs often behave according to a pattern determined by the clock. To find a significant time pattern you need to observe an asset over a period of time and mark significant times such as market openings or closings. It is fully possible to backtest this by going through different time frames and locating areas where price action changed direction or created a retracement in synch with this pattern. What I do is count and analyze the candles in these areas to learn how much time would’ve been needed for a trade to finish in the money and use that to help predict my expiry in the future.

Put it All in Action!

Allow me to summarize my 3 step method for choosing an expiry.

Step 1: Familiarize yourself with your favorite asset and learn how volatile it is by measuring candlestick lengths and the speed at which price moves. Use this to get an idea how much you can expect it to move each day in the future.

Step 2: Analyze all time frames to find key areas where buyers or sellers have challenged the price. Count the number of candles prices moves each time it bounces from support or resistance.

Step 3: Backtest and find out how market time tables affect price movement and use those to predict future movements.

One Expiry to Rule them All

I choose to let the “market makers”, the buyers and sellers, show me their expiries instead of guessing or using my indicators. The idea is to allow my strategy to adapt to the market and not the other way around. I’d like to say that there is one expiry to rule them all but you can’t simply can’t choose base on static rules. This is a common newbie mistake that will have devastating effects on your balance. The price itself is a great indicator, it will tell you what it wants to do, where it wants to go, all you have to listen. Neglect the price and you will be the one who ends up paying. No matter what you do, sometimes your expiry won’t work and that is a part of the game. You just can’t win them all. Luckily though, there are ways to avoid some of the losses. For example; don’t trade during high impact news releases and during times when volatility isn’t acting “normal” (decreasing, stands still or too jumpy).

There you have it guys, a joint effort from our traders/writers, which resulted in an extensive article about choosing the right expiry time. It will get you far but it won’t put money in your pockets, so make sure you do your own part, which is learning and practice. Good luck out there!