Tip From the Geek December Recap – The Santa Rally Came To Town

December Trading with the Geek Recap – Another Profitable Month for the Geek

December was another profitable month of trading for Michael Hodges and the Geek Account.

The Santa Rally came to town in December, after a quick head fake of course. December was a strong month for the US market as it reached new highs, yet again. Unwary bulls did not remain unscathed however as a quick correction to support, driven by plunging oil prices, provided a great entry for the more savvy of us. I won’t lie, I lost some money on the SPX when it corrected during the second week of the month but I was at least able to pick myself up and get back in for winning trade the very next week. Other markets were also moving, oil for one. November ended with an OPEC meeting expected to support prices, it didn’t and they fell all month long. All in all it was a good month for the Geek Account; I closed the month out with a 72% win rate.

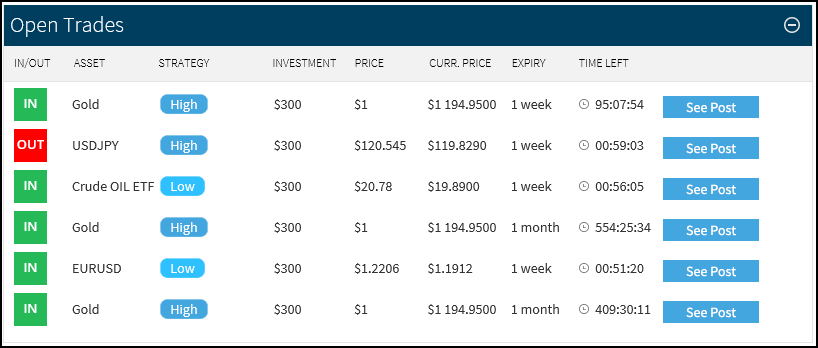

There were 5 Monday’s in December, with 5 tips each week, for a total of 25 tips in the month, not counting any bonus trades I may make. Out of those 25 tips there are only 2 not closed, monthly gold calls, and they are so deep in the money I’m counting them as wins in this recap. So, out of those 25 tips I profited on 18 of them for a win rate of 72%. This is really cool because it matches the long term success rate of the Geek Account and the predictions I made for December in the 2014 Year End Recap. My total cost of trading was $7,500, $300X25 trades, with a gross return of $9,990 and net profit of $2,490. Net profits are just over 33% of investment and roughly 17% of total account value, pretty dam nice.

Total Cost Of Trading = $7,500

Total Return On Investment = $9,990

Net Return = $2,490 or 33.2% ROI!

There were numerous factors swirling together affecting the market last month. For one, conflicting economic data from the US and the rest of the world had monetary policy and expectations diverging like two roads in a wood. One led to strong dollar, and one led to weak euro and yen. Other factors include plunging oil prices which have been carrying oil stocks down with it, and even caused a minor correction in the indices.

The S&P 500

This is my top traded asset and one that I normally trade every week. December I only traded it 4 of the 5 weeks because of the holiday season trading environment, one that I am least fond of. I didn’t trade the SPX the week between Christmas and New Year’s. It was a good call too, I am bullish short to long term, but fearful and unsure of a pullback in the near term, which made choosing a trade in either direction risky, and the market did not disappoint. I did make 4 trades and of them won 3. They were all calls, in line with trend following signals, but one turned out to be false; I fell prey to the oil led correction the week of 12/8.

Gold Is Bottoming

Gold is bottoming and that made price action a little erratic. Gold is being held down by strong and rising dollar value, but held up by the longer term outlook for interest rates. At first I tried to catch the day to day swings in gold but opted to take a longer term approach mid-month. Volatility was killing me on the short term trades so I switched to buying long term calls on the dips, and ended up making some money. I made 5 trades on Gold, the first 3 failed but the last 2 are firmly in the money.

The Yen Is Still Sinking

The yen was losing value versus other major currencies and the government wanted it that way. The economic policies of Abe and Kuroda rely on low currency values and they are both expected to do even more to lower yen value. The USD/JPY pair continued its uptrend in December, with one pullback to support I was able to catch, and is likely going to go higher next year. I traded the yen 5 times, and profited on 4 of them. I caught one pullback on a technical signal but missed out on another one.

Oil Slipped To New Lows

The month started with OPEC not meeting expectation to support prices and then ensued with a semi-price war between members. Oil prices, and the USO oil ETF, began to fall and did not stop until they hit multi-year lows. I trade the USO 5 times, four of them in line with the down trend and one betting on a snap back, and profited on four of them. The snap back never came but I wasn’t stuck on it. A return to the trend corrected that mistake.

Giving Up On Germany

I like Germany, I used to live there, its cool and good. But I may be giving up on trading it. I have had a hard time with it recently and did not do so good this month. My first call paid off, then the second did not, and since my analysis was so far off I gave it up after the 2nd week.

Apple Fills The Void

I turned to Apple in order to fill the void left by the DAX. Apple was a good choice as it is a great consumer products company, and it was the Christmas season. I traded Apple 3 times and profited on all three. The timing couldn’t have been better, I got back into this asset just after a correction to long term support and the rode it higher for three weeks.