The Strangle Strategy – Adapting it for Binary Trading

Full Review of the Strangle Strategy for Binary Options

I’ve been thinking…the Straddle and Strangle strategies are so powerful when used for Vanilla Options and I would like to find a way of using them for Binary Options trading. But how to do it? Is it really possible? Well, at least I am going to try. First of all let’s find out exactly what a Strangle is.

How does a Strangle work? Vanilla Options

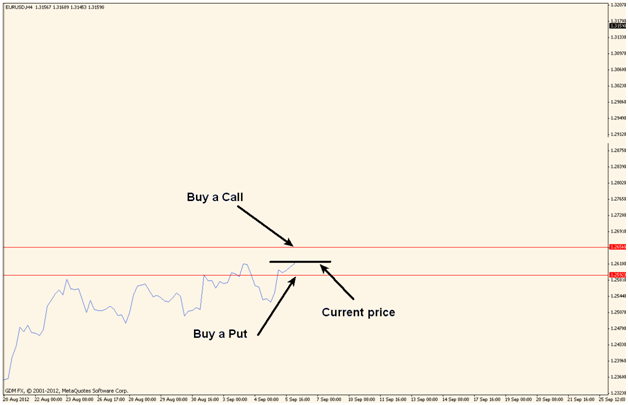

A Strangle strategy implies purchasing a Call higher than the current price and a Put lower than the current price. At the moment of purchase they are both Out of the Money. It must be clear for everyone so here’s the picture:

So we now have a Call above and a Put below current price. This means that we only need strong movement in either direction. We don’t really care about direction because if price goes higher, the Call will be in profit and if price goes lower, the Put will be in profit. As long as the underlying asset keeps moving in one direction, my Strangle will be in profit (after the Break Even point is surpassed). Let’s recap: I don’t need to know the direction of the underlying asset and I will still make money. Great! All I need is strong and sustained movement in either direction. But let’s not forget that we are Binary Options traders. Let’s see how the Strangle performs when it comes to Binaries:

How does a Strangle work? Binary Options

Hmm…first of all, I might have a problem when trying to buy a Call or a Put anywhere else than the current price. To put it bluntly: it is not possible!

Ok, then my Strangle is impossible to apply for Binary Options trading? Is this powerful strategy reserved just for Vanilla Options traders? I sure hope not as I really want it to work for Binaries also. Just when I was about to give up and conclude that the Strangle cannot be used for binary trading, it hit me: the answer must be Touch/No touch binary options. With Touch/No touch trading you bet that price will reach a certain level before expiry time. So to make the Strangle work, we will chose a Touch option for a higher level (strike price) than current price and another Touch option for a lower level than the current price. Now if the underlying asset starts to move strong in either direction, one of my two binary trades will be profitable. Does this mean that the Strangle strategy works for Binary options? I would say that it is just a theoretical approach and in real market conditions, there are a lot more factors that must be taken into consideration: what’s the payout for a successful Touch trade? Does my broker allow me to open two opposite Touch trades? If one of my options is profitable, will the profit cover the cost of my losing trade? These are all specific questions that can be answered only depending on the exact conditions offered by the broker that we are trading with.

Why does the Strangle suck for Binary trading?

First of all, using two Touch Options is not really a true Strangle, but it’s the best adaptation that I could come up with. Now the problem with using two Touch Options is that usually the broker compels us to set them far away from the current price so there’s a big chance that none of them will be touched until expiration time and I could lose on both of them. But then again, this depends a lot on the broker that you are trading with.

Why doesn’t the Binary Strangle suck?

If we are trading with a broker that offers a high payout for a successful Touch option and the markets are volatile enough to reach at least one of my targets, I can make money from a Strangle. The important condition is to have such high payouts that one of my Touch trades covers for the cost of both trades. Here’s a hypothetical example:

– Invest $100 on each trade and each has a potential payout of at least 101%

– If one of the trades reaches its target, I will make $101 profit

– The cost of the second trade is covered by the profit made on the first trade and I get one extra buck. Ka-ching!

From the example above, we can see that everything above 100% payout is profit for me and remember that there are some brokers that offer up to 300% payout…now that would really make my Strangle work, wouldn’t it?

Wrapping it up

Using a Strangle for Binary options trading might prove to be profitable, but there are still a lot of questions to be answered and I think the most important one is “How far away from the current price can I set my Touch Options?” If the broker just offers Touch Options that are very far away (800 – 1000 points) from current price, that will increase the possibility of both my trades to end up losing. To make the long story short, the success of the Strangle in the form we talked about is highly dependent on the conditions that a specific broker offers.

Don’t feel like you’ve understood how to adapt strangle to binary options? Ask Bogdan and our experts on the Forum!