Never Heard of Online Trading Strategies? Have No Fear, We are Here to Help!

We talk so much about trading strategies, good or bad, free or not, scams or legit ones, but what exactly is a trading strategy and how do we differentiate the crap from the gold? What should a good strategy look like? Does the so-called “Holy Grail” really exist? I’m going to try to shed some light on the things above, so let’s go slow and start at the beginning.

First Things First: What Is A Trading Strategy?

To make the long story short, a strategy is a set of rules that you follow when you trade Contracts For Difference, Forex, Crypto, Binary Options or whatever else. But I know you don’t always like the short story so let’s dig a bit deeper: according to Wikipedia, “in finance a trading strategy is a fixed plan that is designed to achieve a profitable return by going long or short in markets”.

The development of a strategy is composed of 8 steps, which include formulation (defining the rules), translating those rules in computer-testable form, preliminary testing, optimization, evaluation of performance, trading the strategy, monitoring performance and finally, refinement and evolution. Of course, not all of us are able to follow those exact 8 steps (for example, I have absolutely no coding skills so I cannot put my strategies in a computer-testable form), but the main steps/parts should be there. Which ones? Well, according to me, here they are:

Defining clear rules for trading: When am I going to open a trade?

Defining clear rules for money management: How much am I going to risk on each trade? How many trades can I open at the same time? (Please note that money management is so much more than these 2 example questions)

Testing the strategy: backtesting, paper trading, demo trading, forward testing deciding when Not to trade: find the situations in which your strategy performs the worst and avoid trading then

One more thing you should know about trading strategies: they are based on technical and fundamental analysis (some strategies combine both aspects). The technical strategies use chart patterns, candlestick patterns, indicators, price action, support and resistance, while the fundamental strategies are related to macroeconomic and geopolitical events like interest rates, employment data, inflation data, press conferences, speeches of heads of central banks, etc. Now that we know what a Trading Strategy is, let’s see what a good strategy should look like.

What Should You Look For In A Trading Strategy?

Did you ever hear a guy saying something like: “Hey, what was your strategy?” And the other guy replying “I went long on Oil”. There are guys for whom going long (bullish/up/buy) or short (bearish/down/sell) is a strategy. Although this is not literally wrong, I don’t think that a trading strategy is limited to that and I could never look at it this way.

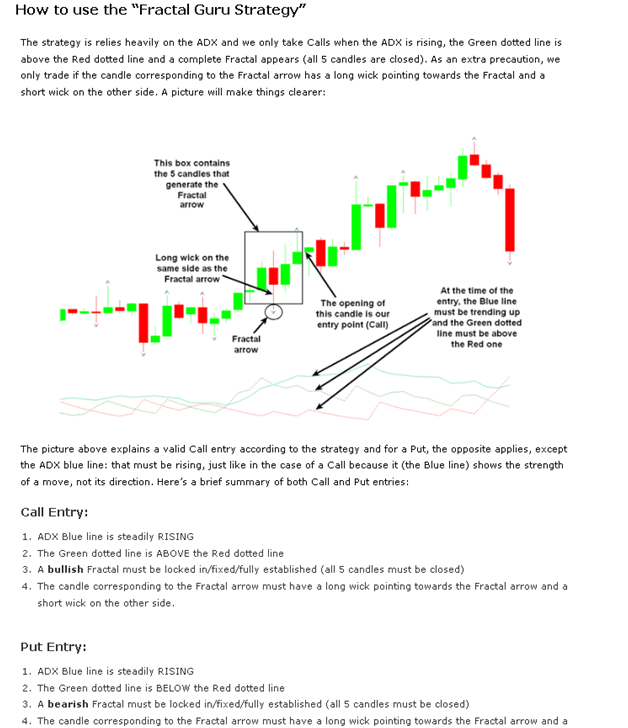

Instead, I consider that the strategy is the reason behind my Buy or Sell and it has to contain predetermined conditions that need to be fulfilled for me to enter into a trade. Let me elaborate on that with the use of the always helpful, Mr. Example: Look at the picture below to see what I consider a good explanation of a strategy. Keep in mind that the strategy in the pic is explained for binary options trading but it works just as well for CFD trading; just replace the words Call and Put with Buy and Sell. Click here if you want to read the whole “Fractal Guru” Strategy article.

Now that’s a real strategy; I’m not saying that it’s the best one, but at least it is explained thoroughly and it has none of the ingredients of a scam. A picture is worth a thousand words so the explanation of a strategy should always contain at least one picture of a valid signal provided by that strategy. Furthermore, I think that a real, honest strategy should have crystal clear rules and shouldn’t let you guess anything. A good source of strategies is YouTube, but… be very careful if you choose to use a strategy found there because a lot of them are just uploaded for promotional reasons, to make you invest using a certain broker or even buy a certain product. Finally, I think that a solid strategy should have a basic structure similar to the one below:

Basic Trading Strategy Structure Example:

Entry rules: Why should I open a Bullish (Buy/Call) or Bearish (Sell/Put) trade? The reasons are practically infinite and vary from strategy to strategy, but it needs to give you clear rules. Something like: “Buy/Call if EMA 17 (exponential moving averages) and EMA 43 cross bullish and Sell/Put if they cross bearish”. This is an example of a clear and strict entry rule, but I hope you won’t be trading based on that because I just made it up for this example.

Exit rules: When should I get out of a trade if it goes against me? Also, when should I get out if the trade is profitable? How much profit is enough profit? Any good strategy should give you the answer to those questions. After all, we can’t just enter the trade without thinking about a plan, whether the trade is profitable or not.

If you are trading CFDs, the strategy should tell you where to place the Stop Loss and Take Profit orders. On the other hand, if you are trading Binary Options, most brokers have tools that allow you to close a trade before expiry time and your strategy should tell you when to get out and receive back some of the amount invested in that trade.

Money management: How much should I invest in a single trade and how many trades should I have open at the same time? Now think about this: if your entire account is $1000 and you invest on a single trade $500 (that means 50%), just two losing trades would wipe out the entire account, but if you use a smaller percentage for each trade, you have more chances to stay in the game longer and survive a streak of losing trades.

How A Scam Trading Strategy Looks Like – Strategies To Beware Of

There are traps for new traders everywhere and one of the most dangerous is the Brain Wash Strategy scam. You probably came across one but didn’t know it. Let me tell you what that looks like. Usually, you will land on a long website where you can only scroll down to read some endless and regurgitated garbage about how much money you can make practically overnight. Sounds familiar? Here are some more hints. In most cases, the strategy presented is invented/created by a very “successful” trader. A “supertrader” that allegedly has millions of dollars, but for some unknown reason wants to share his secret with me (maybe he has a kind heart). If I venture further into the page, I will probably be informed that I don’t need any financial market knowledge to be successful with his strategy and if I read between the lines, he basically tells me that it’s OK to be retarded because I will still make money.

After seemingly thousands of scrolls down I get to the Testimonials where other regular people like me, tell me how much money they made… yeah right, and I was born yesterday. Don’t fall for that, they are paid to tell you this. Finally, I get to the juicy part where the “Guru” makes me an offer I can’t refuse. Normally the price for the strategy is $99 but because I’m such a nice and lucky guy, I can buy it for just $39.99. But wait, if I “act now”, I can get it for the measly sum of $19.99. Lucky me! But a question still bugs me: why would such a great trader sell his “money printing” strategy for a few bucks? If the strategy is that good, he could just place some trades and make huge amounts of money – a lot more than he would make by selling it. Oh, wait, I know – because it is a SCAM and it DOESN’T work! When someone tells you that it’s easy to make money overnight in the financial market, just hit the “X” button in the upper right corner and move on. Don’t pay a dime for any strategy that looks like the one that I described above.

Ok, let’s assume that you take my advice and don’t pay a dime for a strategy that looks like the one I just described. That’s a bullet dodged… great! But the scammer’s “gun” has more than one bullet and let me tell you about another trick: those one-page websites that look like (and really are) long sales letters, brainwash you into depositing money with the broker they advertise. Ads of a certain broker pop out all over the page, urging you to invest with “The best broker ever!” That’s crap! And most of the time the advertised broker is a scam as well. Newbies are easy prey for the seasoned scammers and even if they can’t get newbies to buy the strategy, maybe at least they can get them to deposit some money with the advertised broker. If the new guy also buys the strategy… well, two for the price of one… time to party for the scammer, because you know what the next step is once the money is deposited? The black hole of the scam realm absorbs it all… and if you try to withdraw, the problems start to appear. The money will never reach your bank account and if you confront the broker about it, you will just receive some stupid explanation like “Oh, we are sorry but your bank did not accept the transfer.”

My blood pressure starts to rise because I know that things like that really happen. So I am going to wrap it up with a final piece of advice: do not buy anything from a website that pretends to sell you a magic strategy or an auto-trading robot that will make you money guaranteed (and fast), has a lot of links, pop ups or downloadable items or has any of the characteristics described in this section. Most strategy and robot sellers will offer their product for free if you deposit a certain amount with their recommended broker, so please do not collaborate in any way with a broker advertised on one of those sites (even if the product price is Zero). This is free advice so take it or leave it, but I think you will regret it later if you don’t take it.

Where To Find A Good Trading Strategy?

There are probably thousands of trading strategies all over the internet, some are good, some are bad and some are just disgustingly stupid. But unfortunately, I cannot give you a clear map as to where the right strategy for YOU is located because every trader has a certain mentality and comfort zone. If you take a trader out of that zone, mistakes are more likely to happen and that’s why a strategy that works well for one trader can be disastrous for somebody else. Start here, on our college section, and if you cannot find what you like, go to our All Trading Strategies page and go wild with almost 100 different strategies, all explained by us in a friendly manner. Take your pick and find the right one for YOU.

You might think that I’m subjective, but I consider ThatSucks.com to be the one place where you can find good and clearly explained strategies. A recommendation regarding a strategy is OK, but ultimately, you have to decide what strategy suits you and what you are comfortable with. I like trend following strategies and I recommend them, but I would never try to convince anyone to use a strategy just because I like it.

I mentioned the Holy Grail in the opening paragraph, but some of you might not be familiar with this term used for trading strategies: it refers to a strategy that makes money 100% of the time, it never fails and it makes you rich, guaranteed. Does it exist? No! Sorry guys, but it doesn’t exist, so stop looking for it. The good news is that with enough work, discipline, and perseverance (and probably some other important stuff that I forgot about), you will come close to your own Holy Grail. It is not something easily achieved, but the truth is, “No Pain, No Gain.”

The Strategic Conclusion

The importance of a reliable strategy is crucial if you are serious about making money out of trading. But equally, or even more important, is your mindset and your psychological approach of this business. My greatest “Eureka!” moment was when I realized that a good strategy is not all you need; you also need to put in the work and train yourself. Yes, the path is difficult but ultimately, rewarding. Whatever you do, make sure to stay away from scams and don’t give your hard-earned money to guys that promise you incredible and easy to achieve wealth. Avoid them at all costs and think about this: if you had the Holy Grail of strategies, would you tell it to everybody? Probably not… so don’t assume that some guy, a self-proclaimed “expert”, will just hand it to you for a couple of bucks or for free.